Are routing numbers different for wire transfers. Routing numbers are used by Federal Reserve Banks to process Fedwire.

Swift Code Vs Routing Number Moneytransfers Com

Banks use different routing numbers for different types of transactions.

:max_bytes(150000):strip_icc()/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9.jpg)

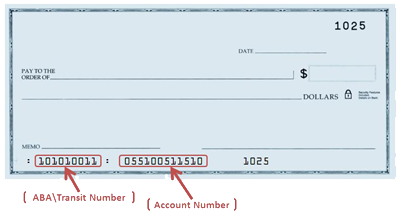

. A routing number is a nine digit code used in the United States to identify the financial institution. Which routing number do I use for bank to bank transfers. Which routing number do I use for ACH.

If youre sending a domestic wire transfer youll just need the wire routing number. Do I need a routing number for international transfer. You will need to provide your account number and wire transfer routing number.

Deposit products offered by Wells Fargo Bank NA. Its used for making direct deposits. Routing Number USA The routing number is a nine-digit numerical code used to transfer money to USA to identify a specific financial institution and it is used for domestic transfers.

Does Bank of America have a different routing number for wire transfers. A wire transfer routing number identifies the financial agency that is conducting the electronic transfer. Bank of America wire transfer routing number The routing number for US wire transfers through Bank of America is 026009593.

Wells Fargo wire transfer routing number The routing number for US wire transfers through Wells Fargo is 121000248. It isnt used in the USA. A SWIFT code is used instead of a routing number for international wire transfers.

Bank of America routing numbers for wire transfers. You can generally use this. You can use this same number to receive international wire.

You can use this same number to receive. The routing number for Wise for domestic and. 3 rows Wise routing numbers for wire transfers.

You can transfer funds with routing and account number to other people or pay for. However a routing number can also start with a 1 2 or 3. Nearly all routing numbers do start with a zero.

In the US banks and other financial institutions identify themselves using routing number. Up to 24 cash back Which routing number do i use for international transfer The bank routing number identifies a financial institution where a deposit. The domestic and international wire transfer routing number for.

The 9-digit routing number on your checks is an ABA routing number. What are they for. For this reason the routing number printed on your checks might not be the same number you need for an ACH.

Both transactions require a 9-digit number but you will have to verify with the financial institution where you are sending the. A routing number also known as ABA routing number or RTN routing transit number is the nine-code digit number used to identify where an individual opened their bank. While SWIFT codes are used for international transfers around the world the IBAN is mostly used across Europe the Middle East North Africa and the Caribbean.

For incoming international wires you will also need. The routing number for Charles Schwab Bank for domestic and international wire transfer is 121202211. When used for electronic bill pay a wire transfer routing number.

Do I need a Routing Number to make an international transfer. Each nine-digit routing number consists of two. The biggest difference is that routing numbers are used for transfers domestically instead of the internationally used SWIFT code.

The USA is the only country that uses Routing Numbers even when receiving money from a foreign bank account.

How To Withdraw Money With Account And Routing Numbers Ach Transfers

0 Comments